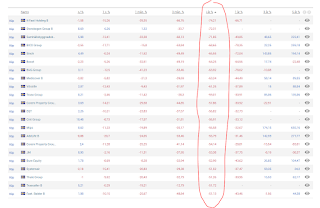

This can happen anytime, to anyone in any stock market. Private investor can suffer really badly if they put a lot of savings in the stock market. It is not easy to be an investor in a down going market. Some of the people i follow had millions in their accounts, and now, only a few left. One person have already a drop of -60% in his portfolio. It means it has to go up by 150% to break even. I feel so sad for him, he still believes it will happen. I highly doubt it.

I believe that even rich people get wiped out. Or maybe I should say, especially rich people. Bitcoin is also going down fast, some said that it has hedge against inflation, no it does not. Even gold is going down, when big market drop comes, everything is going down. Only thing to do is to hold cash, but hold it for too long and inflation eats it up. You want to be invested, at least most of your money.

Many people cant pick good stocks, even if they do, even the good stocks fall from time to time. Selling and buying it back cost unnecessary fees. Most people dont even beat the indexfond. Why even try then, just buy the index and forget about the market. It will go back up and you will beat most of investors just by holding indexfund.

For the people who do have money and who do have time to make research, amazing opportunities like this dont come often. Many of the people i follow are buying heavy. I saw even the management teams and CEOs are buying shares like never before. They are also people, but they know how the quarter has been. I think the second quarter will be just as good as the first one with words like: uncertain future lies ahead. Its always the same, things dont change too much. Good, profitable companies will still be good even during reccession.

Två Månadslöner

You are 100% correct. Individual stocks are tricky. YOu really have to do your research. Even though I own individual stocks (mostly because it is fun), I have always adheared to the great advice to invest and to sperad my investments across four different types of mutual funds: Growth and income funds, growth funds, agressive growth funds, and international growth funds.

ReplyDeleteIn addition, historically the stockmarket is like a rollercoaster-ride. It goes up and down, so we have to remember that over time tis is normal. And just like if you were om an actual rollercoaster ride, the only people that will get hurt are the ones that jumps off in the middle of the ride.

Great post!

Have a good Saturday,

W/r Anneli

(P.S. Now that your are writing in English, have you considered changing the name of your blog to something like Two Paychecks? :-)

Hi, thank you for your comment ❤ The blog will go back to swedish language again from 1 of July. It did not fullfill my expectations.

Delete